As an expat, the most significant thing you have to know is that 1 US dollar is 3.75 Saudi Riyal, which has been the case for quite a few decades. With time, resident expats and foreign individuals have started realizing the benefits of investing in Saudi Arabia, primarily because of the growing investment vehicles. Multinationals with deep pockets have long believed in foreign investments.

However, exciting new options are emerging for entrepreneurial expats in various areas, such as investment funds, property, and start-ups.

Investment in the Kingdom of Saudi Arabia

There is no denying that the investment business in Saudi Arabia is enormous. In 2018, KSA received SR 13 billion in foreign direct investment. Besides that, KSA is also known for ranking 41st on the Global Foreign Direct Investment Country Attractiveness Index.

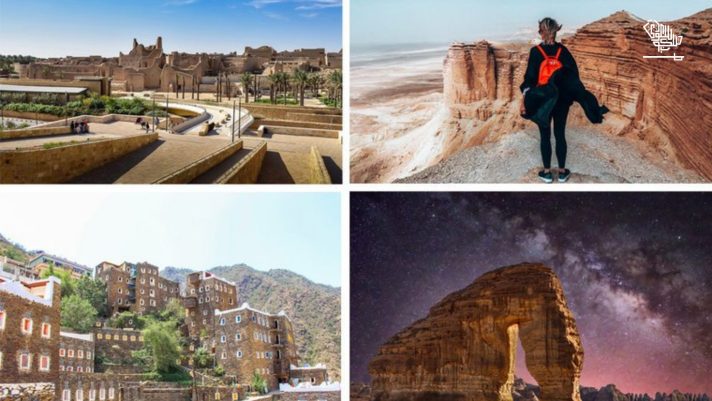

According to the reports, the government is interested in attracting more significant foreign investments in emerging sectors. These will include health, infrastructure, logistics, education, clean energy, mining, defense, entertainment, and tourism.

In mid-2015, the stock market of KSA opened its doors to foreign institutional investors. Per the Ministry of Housing Approval, non-Saudis can also purchase property here.

Investing in the Saudi Arabia Stock Exchange

Even when oil prices are seriously dropping, the stock exchange of KSA is responsible for dominating investment in the six-country Gulf Cooperation Council. However, international investors looking for better horizons need to know that the marketplace is ideal for deep pockets.

Tadawul, the stock exchange of Saudi Arabia, allows only established institutional foreign investors to trade. To qualify, a foreign investor needs to have $5 billion in asset management and have been in business for at least five years.

Investors who have not reached the billionaire mark yet can invest in modest amounts in KSA. They can also invest in surrounding regions through exchange-traded funds focusing on the companies of the Middle East. For example- WisdomTree Middle East Dividend Fund (GULF), SPDR S&P Emerging Middle East, and Africa ETF (GAF).

Limits associated with direct investment in the Saudi Stocks

There are several limits associated with directly investing in Saudi Companies.

● Foreign investors cannot own more than 5% of shares in any company.

● Whether residents or non-residents, foreign investors cannot own more than 49% of shares of any company collectively.

● Every qualified foreign investor is limited to only 20% of a company’s shares, along with 10% of all the claims of all listed companies on the exchange.

Ex-pats interested in investing in the KSA stocks typically operate through global institutions that conduct business here. The international banks with offices in Riyadh are Credit Suisse Group and Morgan Stanley. These branches are the hubs for every broker and qualified foreign investor investing in the GSC nations.

Tadawuhl

There is no denying that Tadawuhl is known for its prominent role in Arab affairs; however, only 150 companies are listed here. The primary index tracking the movements of Tadawuhl is TASI or the Tadawuhl All-Share Index. Saudi Aramco, the biggest company in the world, is also among them.

According to the Heritage Foundation, Saudi Arabia’s economy has grown modestly in the last few years because of reduced oil production and prices, despite oil being the main export product. However, KSA is still among the top 20 world economies and the largest Middle East economy.

This slide-in demand for oil has made the Saudis work on diversifying the KSA economy, thereby encouraging private companies unrelated to oil. They are also trying to dabble in solar energy.

DISCLAIMER: The images/videos/logos showcased on this page are the property of their respective owners. We provide credit and sources wherever possible. However, If you find that your image/video is displayed on this blog without authorization, please contact us with the relevant details and a link to the image, and we will promptly address your concerns.

Maira is a passionate blogger with a creative soul. When not crafting engaging content, she immerses herself in painting, explores new worlds through books, and seeks inspiration from her travels. Her writing reflects her love for art, literature, and adventure.