Quick Facts: Weakest Currencies 2025

- Weakest currency: Lebanese Pound (LBP) – 89,600 LBP = 1 USD

- Fastest depreciating: Zimbabwean ZiG (ZWG)

- Asia’s weakest: Iranian Rial (IRR), Vietnamese Dong (VND)

- Africa’s weakest: Sierra Leonean Leone (SLL), Guinean Franc (GNF)

- GCC contrast: Saudi Riyal (SAR) remains one of the world’s most stable currencies

The Lebanese Pound (LBP) holds the title of the world’s weakest currency in 2025, trading at nearly 89,600 per US dollar. Other struggling currencies include the Iranian Rial, Vietnamese Dong, and Sierra Leonean Leone, each of which is affected by inflation, sanctions, or poor economic management.

While these currencies continue to lose value, the Saudi Riyal (SAR) remains one of the world’s most stable, backed by strong oil revenues and its peg to the US dollar. This guide ranks the top 10 weakest currencies, explains why they collapsed, and highlights what travelers, investors, and expatriates should expect.

Updated Summary Table: Top 10 Weakest Currencies in 2025

| Rank | Currency | Value vs USD (Sept 2025) | Key Reason for Weakness |

|---|---|---|---|

| 1 | Lebanese Pound (LBP) | 89,600 = 1 USD | Hyperinflation, banking collapse, political crisis |

| 2 | Iranian Rial (IRR) | 42,000+ = 1 USD (official) | Inflation, weak reserves, and lack of trust |

| 3 | Vietnamese Dong (VND) | 25,000+ = 1 USD | Undervaluation to boost exports |

| 4 | Sierra Leonean Leone (SLL) | 21,000+ = 1 USD | Redenomination, inflation, weak infrastructure |

| 5 | Zimbabwean ZiG (ZWG) | ~13.5 = 1 USD (post-redenomination) | Inflation, weak reserves, lack of trust |

| 6 | Laotian Kip (LAK) | 22,000 = 1 USD | Small economy, heavy debt, inflation |

| 7 | Indonesian Rupiah (IDR) | 16,000 = 1 USD | Import dependency, inflation pressure |

| 8 | Uzbekistani Som (UZS) | 12,500 = 1 USD | Economic transition, inflation |

| 9 | Guinean Franc (GNF) | 8,600 = 1 USD | Political instability, resource mismanagement |

| 10 | Paraguayan Guarani (PYG) | 7,400 = 1 USD | Weak economy, low global influence |

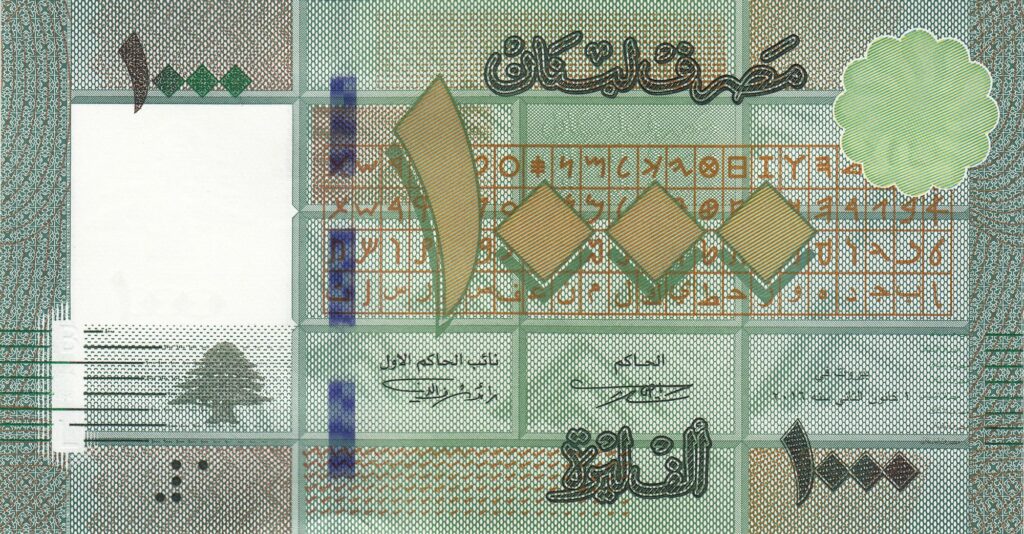

1. Lebanese Pound (LBP)

The Lebanese pound remains the weakest currency in 2025. Years of political deadlock, banking collapse, soaring inflation, and public unrest continue to push the LBP down. 1 USD ≈ 89,600 LBP | 1 EUR ≈ 96,000 LBP | 1 SAR ≈ 23,800 LBP. Without structural reforms, Lebanon’s economy remains fragile, keeping the pound at record lows.

2. Why is the Iranian Rial (IRR) among the weakest currencies?

The Iranian Rial (IRR) trades at roughly 42,000 per USD officially, but black market rates are far higher. Sanctions, inflation, and restricted trade weigh heavily on its value.

Saudi/GCC context: Iran’s weak currency complicates trade with GCC neighbors and reflects regional tensions.

Outlook: The Rial will remain under pressure unless sanctions ease.

3. Why is the Vietnamese Dong (VND) undervalued?

The Vietnamese Dong (VND) trades at 25,000+ per USD. It is deliberately undervalued to make Vietnam’s exports more competitive.

Saudi/GCC context: Popular with Saudi travelers to Southeast Asia, the Dong stretches Riyal spending power significantly.

Outlook: Vietnam’s economy is growing, but undervaluation is likely to persist.

4. Why has the Sierra Leonean Leone (SLL) collapsed?

The Sierra Leonean Leone (SLL) is valued at over 21,000 per USD following the 2022 redenomination. Poor infrastructure, inflation, and economic mismanagement have further weakened it.

Saudi/GCC context: For Sierra Leonean expatriates in Saudi Arabia, Riyal remittances have immense purchasing power back home.

Outlook: Continued weakness is expected unless major reforms are implemented.

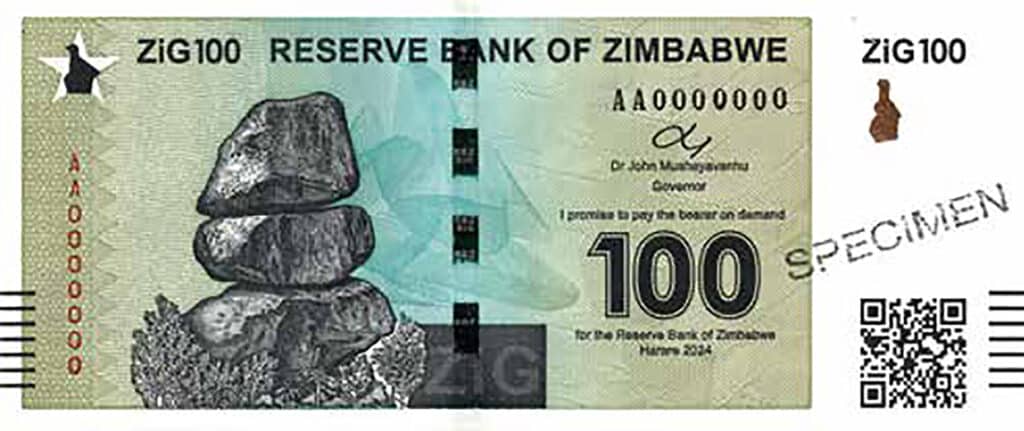

5. Why is the Zimbabwean ZiG (ZWG) still among the weakest?

Why is the Zimbabwean ZiG (ZWG) still among the weakest?

The Zimbabwean ZiG (ZWG), introduced in 2024 to replace the failing Zimbabwean Dollar, continues to rank among the weakest currencies in 2025. Despite the redenomination, inflation, economic mismanagement, and lack of foreign reserves have kept it fragile.

Saudi/GCC context: Zimbabwean workers in Saudi Arabia send remittances home in Riyals, which convert to very high local amounts, highlighting again the strength of Gulf currencies compared to volatile African ones.

Outlook: Unless major fiscal reforms succeed, the ZiG risks following the same path as its predecessor, with further devaluation expected.

6. Why is the Laotian Kip (LAK) among the weakest?

The Laotian Kip (LAK) trades at 22,000 per USD. Debt pressure, inflation, and a small economy weigh it down.

Outlook: External investment would be needed for any recovery.

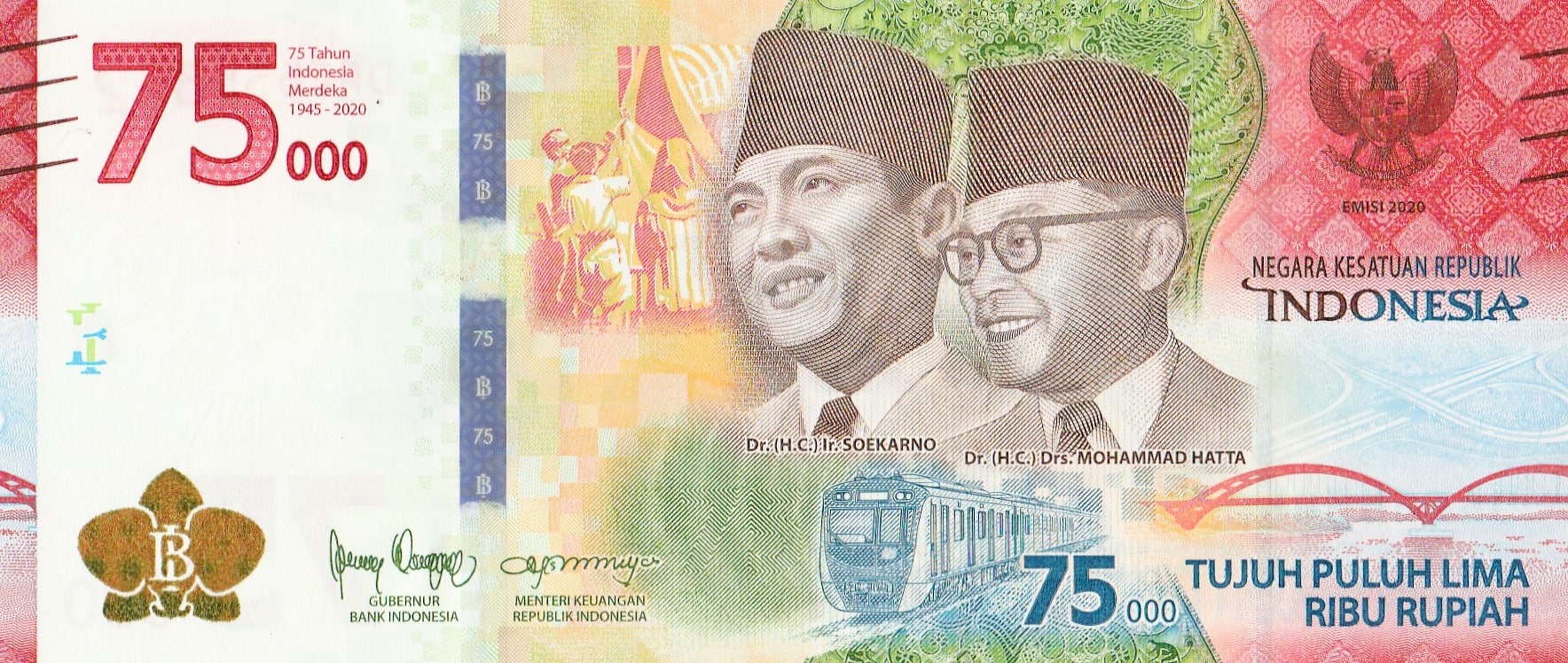

7. Why does the Indonesian Rupiah (IDR) remain weak?

The Indonesian Rupiah (IDR) trades around 16,000 per USD. Import dependency and inflation pressure prevent significant strengthening.

Saudi/GCC context: Millions of Indonesian workers in Saudi Arabia benefit, as Saudi riyal salaries stretch further when remitted home.

Outlook: The Rupiah is expected to remain stable but undervalued.

8. Why is the Uzbekistani Som (UZS) weak?

The Uzbekistani Som (UZS) trades at about 12,500 per USD. The economy’s transition period and inflation pressures keep it weak.

Outlook: Gradual reforms may help, but no quick recovery is expected.

9. Why is the Guinean Franc (GNF) undervalued?

The Guinean Franc (GNF) is currently valued at around 8,600 per USD. Despite resource wealth, political instability, and poor management, the currency has remained weak.

Outlook: No significant recovery expected without political stability.

10. Why is the Paraguayan Guarani (PYG) among the weakest?

The Paraguayan Guarani (PYG) trades at 7,400 per USD. Weak growth and low global relevance keep it at the bottom.

Outlook: Unlikely to strengthen significantly.

Other Weak Currencies in 2025

- Malagasy Ariary (MGA): ~4,500 per USD, weak due to poverty, low reserves, and limited industrial capacity.

- South Sudanese Pound (SSP): Depreciating rapidly due to instability and conflict.

- Burundian Franc (BIF): Struggling with inflation and limited foreign reserves.

FAQs

A. The Lebanese Pound (LBP) is the weakest currency in the world in 2025, trading at nearly 89,600 per US dollar. Years of inflation, banking collapse, and political crisis have pushed it to record lows.

A. The top 5 strongest currencies in 2025 include the Kuwaiti Dinar (KWD), Bahraini Dinar (BHD), Omani Rial (OMR), Jordanian Dinar (JOD), and British Pound (GBP).

A. This guide ranks the top 10 weakest currencies, but others, such as the Malagasy Ariary (MGA), South Sudanese Pound (SSP), and Burundian Franc (BIF), also remain among the lowest in 2025.

A. In 2025, one US dollar has the highest value in countries with very weak currencies, such as Lebanon, Zimbabwe, and Iran. For example, 1 USD equals about 89,600 Lebanese Pounds.

A. The Iranian Rial (IRR) has weakened over the decades due to sanctions, high inflation, and restricted trade. It officially trades at around 42,000 per USD, while black market rates are much higher.

A. The Vietnamese Dong (VND), Iranian Rial (IRR), Laotian Kip (LAK), and Indonesian Rupiah (IDR) are among the weakest Asian currencies in 2025. They remain undervalued due to inflation, sanctions, or export-driven policies.

Conclusion

The Lebanese Pound (LBP) remains the weakest currency in the world in 2025, trading at nearly 89,600 per USD. It is closely followed by the Iranian Rial (IRR) and the Vietnamese Dong (VND), both of which are weighed down by sanctions, inflation, and undervaluation.

In Africa, the Sierra Leonean Leone (SLL) and the Zimbabwean ZiG (ZWG) highlight how redenomination efforts and new currencies can still fail without structural reforms and investor trust.

Other currencies such as the Laotian Kip (LAK), Indonesian Rupiah (IDR), Uzbekistani Som (UZS), Guinean Franc (GNF), and Paraguayan Guarani (PYG) round out the top 10.

By contrast, the Saudi Riyal (SAR) remains one of the world’s most stable currencies. Backed by strong oil revenues, foreign reserves, and its peg to the US dollar, the Riyal protects Saudi Arabia’s economy and ensures security for expatriates sending remittances.

While weaker currencies struggle with inflation and uncertainty, the Riyal underscores Saudi Arabia’s role as a financial anchor in global markets.

Also read: Strongest Currencies in the World 2025

DISCLAIMER:

This blog post is for informational purposes only. We make every effort to provide accurate, current, and well-sourced information, but we cannot guarantee its completeness or absolute accuracy.

All images, videos, and logos used on this page belong to their respective owners. We aim to credit and reference them appropriately. If you are the rightful owner and wish to have your image, video, or logo removed, please contact us.

In my content writing journey, I’ve discovered a deep passion for delving into politics, culture, and history. Saudiscoop has been my chosen platform, resonating with my interests. Beyond writing, I thrive on debating and devouring political literature. While my focus lies in detailed explanations, I relish the challenge of diverse topics. My goal is to create immersive, enlightening pieces that captivate while exploring intricacies.