- Minimum age: 18 years (Iqama required for expats)

- Open via Al Rajhi Mobile App or online portal

- Valid Saudi mobile number required (linked with Absher)

- No initial deposit required for online account opening

- Debit card issued instantly after activation

Al-Rajhi Bank is one of the largest banks in Saudi Arabia. It offers various banking services, including investment, deposits, and credit cards, in accordance with Islamic requirements.

Opening a bank account in Saudi Arabia has never been easier. With Al Rajhi Bank’s online platform and mobile app, both Saudis and expats can quickly create an account without visiting a branch. This guide explains the requirements, documents, process, and common issues to help you open your account in 2025.

| Criteria | Saudi Nationals | Expats (Residents) |

|---|---|---|

| Minimum Age | 18 years | 18 years |

| ID Required | National ID | Valid Iqama |

| Mobile Number | Must be linked with Absher | Must be linked with Absher |

| National Address | Required | Required |

| Email Address | Required | Required |

| Account Type | Features | Monthly Fee |

|---|---|---|

| Current Account | Free debit card, online banking, transfers | None |

| Savings Account | Earn profit on balance, online transfers | None |

| Student Account | For SMEs, payroll, payments, and multiple user access | None |

| Business Account | For SMEs, payroll, payments, multiple user access | Varies |

What Documents Are Required to Open a New Account?

- Valid Iqama

- Saudi Mobile Number

- Nafath Registration

- Valid Nation Address Registration

- Email Address

- Age requirement ( must be 15 or older)

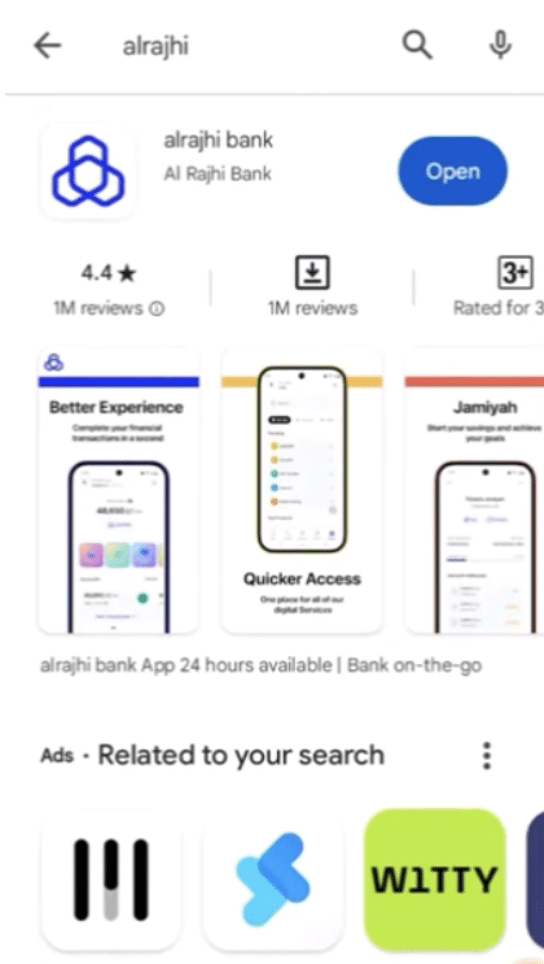

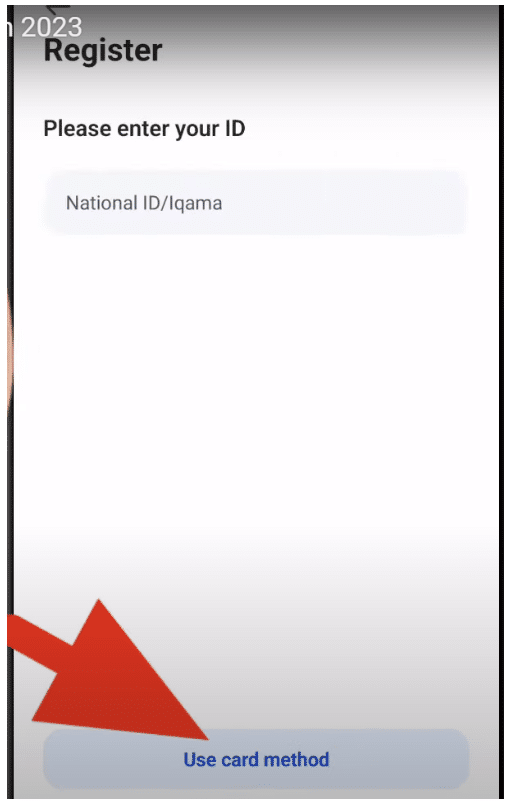

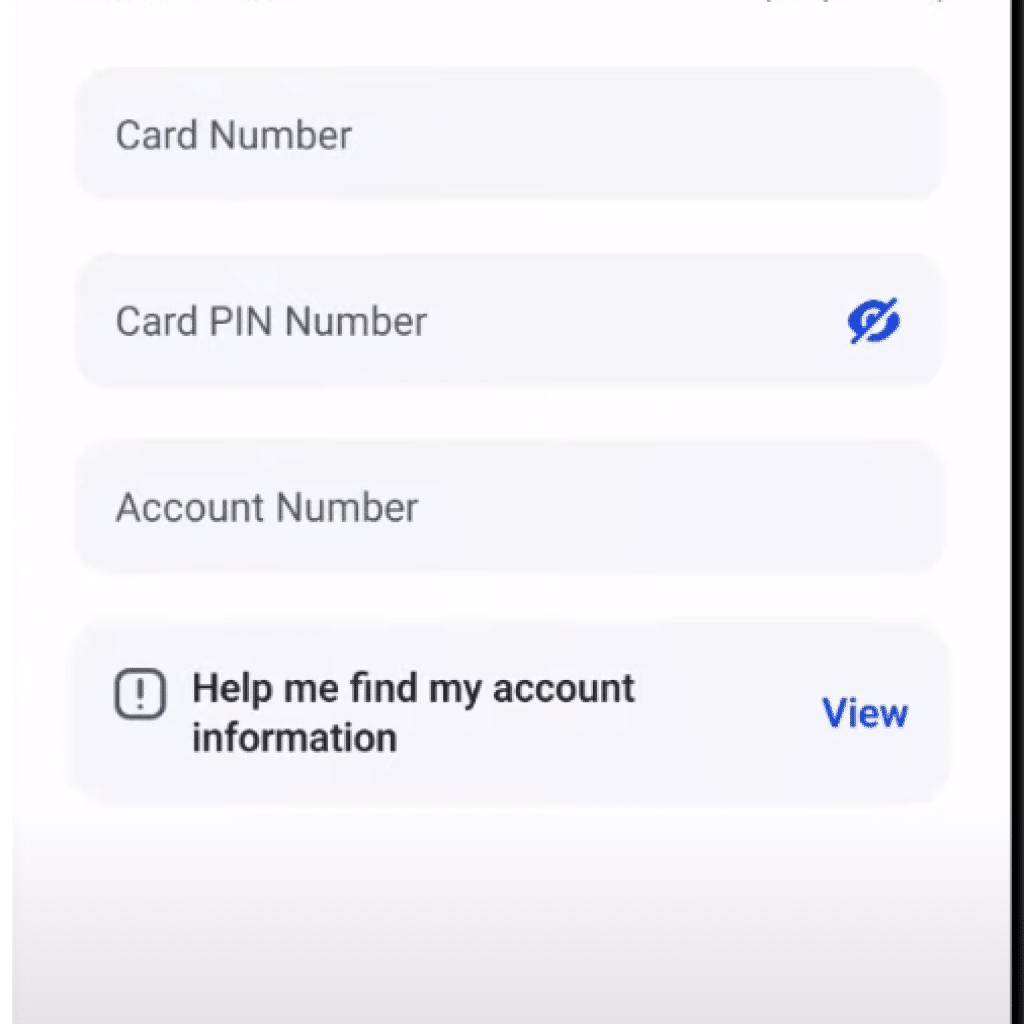

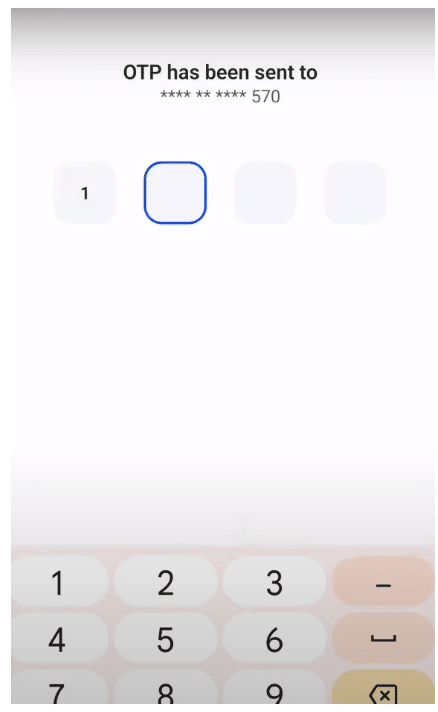

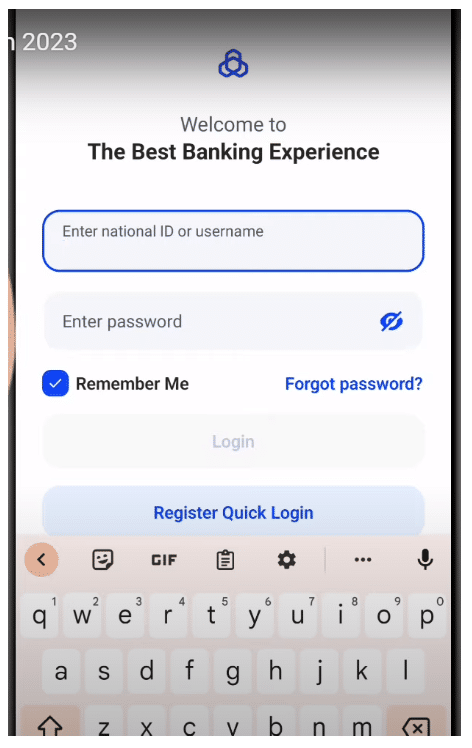

Opening an Al-Rajhi Bank Account Via Mobile App

Download the AlRajhi mobile app from the App Store; it will ask for registration to verify your account. Once your account is verified, you can manage your finances online without visiting the bank or standing in long queues. Here is a step-by-step guide to make your registration process easy.

- Start by downloading the AlRajhi Mobile app from the App Store (iOS devices) or Google Play Store (Android devices)

- Launch the app, click New Account, and agree to the terms and conditions.

- Enter Iqama details and Mobile phone number.

- Enter the verification code sent via SMS to verify your identity.

- Enter your employment details, which include your profession, income source, and monthly income.

- Enter your personal information, such as family name and place of birth.

- Provide FATCA and CRS information.

- Set a username and password for online banking and enter your email address.

- You will receive your account number and IBAN via SMS.

Your online Al Rajhi account setup has been completed successfully. Congratulations! You can visit any of their branches to collect your ATM free of cost or order it through the app.

How to Activate Your New Mada Card

- Login to your AlRajhi App.

- From the “cards” list, choose the “card activation” icon.

- Enter the PIN of your choice, and re-enter the PIN to confirm.

- When you enter the PIN, the card will be activated.

Does The Al Rajhi App Approve Loans

You can apply for personal financing on an app up to SAR 2 Million. Early settlement plans are available upon request at any time.

How to Activate Beneficiaries Online

Click on the “Transfer” button and select the type of beneficiary, local or International. Enter the amount you want to transfer. The bank doesn’t charge if the transfer is made within the same bank, but a fee of 7 SAR is charged if it’s made to other banks within KSA. The cost of an international transfer is 50 SAR.

How to Activate Al Rajhi Phone Banking?

Dial 920003344 from your mobile device and select your preferred language. Then press 0 for the main menu and 1 to register with phone banking. If your mobile number is registered, please accept the terms and conditions and enter the requested information. Examples include a Debit card number, the last 7 digits of your account number, and an ATM PIN code.

You have successfully activated phone banking and can enjoy the benefits 24/7, such as

- Paying your utility bills.

- Pay your Sadad bills or government fees.

- Perform transactions from your mobile or landline.

- Transfer money to local or international accounts.

Al Rajhi offers 24-hour customer service and has a female branch in Abha.

Contact number of Al Rajhi Abha (ladies) branch: +966 – 11 – 2694723

FAQ

Yes, with a valid Iqama, Absher registration, and a Saudi mobile number.

Iqama or National ID, national address, email, and mobile number linked with Absher.

No minimum deposit is required for opening an online account.

Yes, students and employees can open dedicated account categories.

Through the Al Rajhi app or by using any Al Rajhi ATM with OTP authentication.

There are other banking services available in the kingdom that offer a variety of services, such as Samba Bank, Enjaz Bank, and even Saudi British Bank. It’s important to check with your bank and stay informed about their services and the benefits you can receive from them.

Conclusion

Al Rajhi Bank’s digital platform makes it simple to open an account online in 2025. With no initial deposit required, instant verification via Absher, and a debit card available immediately, the process is fast and secure.

DISCLAIMER: The images showcased on this page are the property of their respective owners. We provide credit and sources wherever possible. However, If you find that your image is displayed on this blog without authorization, please get in touch with us with the relevant details and a link to the image, and we will promptly address your concerns.

As a children’s book author, I find joy in crafting imaginative tales. I contribute articles to Saudi Scoop and share my thoughts on my personal blog. My proudest moment? Became an Amazon #1 bestseller with my debut book, “It’s the Moon- My First Book Of Islamic Months,” published by Little Hibba in the UK.